As Europe races toward its ambitious net-zero goals, renewable energy sources like wind and solar often dominate the conversation. But could another crucial piece of the puzzle lie in the next generation of nuclear technology? Small Modular Reactors (SMRs), compact and advanced nuclear reactors, might provide the reliable, low-carbon energy needed to complement renewables. By bridging the gap between intermittent renewable power and Europe’s sustainability objectives, SMRs could help secure energy stability for industries like commercial real estate while driving decarbonization.

But how viable are SMRs in Europe’s energy transition? Could they play a significant role in decarbonizing industries and ensuring a consistent power supply for businesses like CRE? Let’s take a closer look.

What Are Small Modular Reactors (SMRs)?

SMRs are essentially scaled-down nuclear reactors, producing less than 300 megawatts (MW) of electricity, compared to traditional reactors that can generate more than 1,000 MW. What sets them apart is their modular design, allowing for factory-based production and scalable deployment. This makes construction faster, more cost-effective, and easier to implement across various regions with different energy needs.

Key Benefits of SMRs:

Enhanced Safety: Safety concerns have long haunted nuclear energy. SMRs, however, offer advanced safety features that directly address issues from past disasters like Fukushima and Chernobyl. Their passive cooling systems use natural forces such as gravity and convection to cool the reactor in case of an emergency, meaning they can safely shut down even in total grid failure. Many are also built underground or in well-protected environments, further minimizing risks from external threats.

Lower Capital Costs: Thanks to their smaller scale and modular production, SMRs promise to be more cost-effective than traditional nuclear projects, reducing the financial barriers to nuclear energy.

Scalability: SMRs can be deployed incrementally to meet regional demand, making them flexible for different scales of energy needs.

Minimal Land Use: SMRs occupy a much smaller footprint than renewable energy sources like wind or solar farms—an advantage in densely populated or industrial regions.

Europe’s Energy Needs and the Role of SMRs

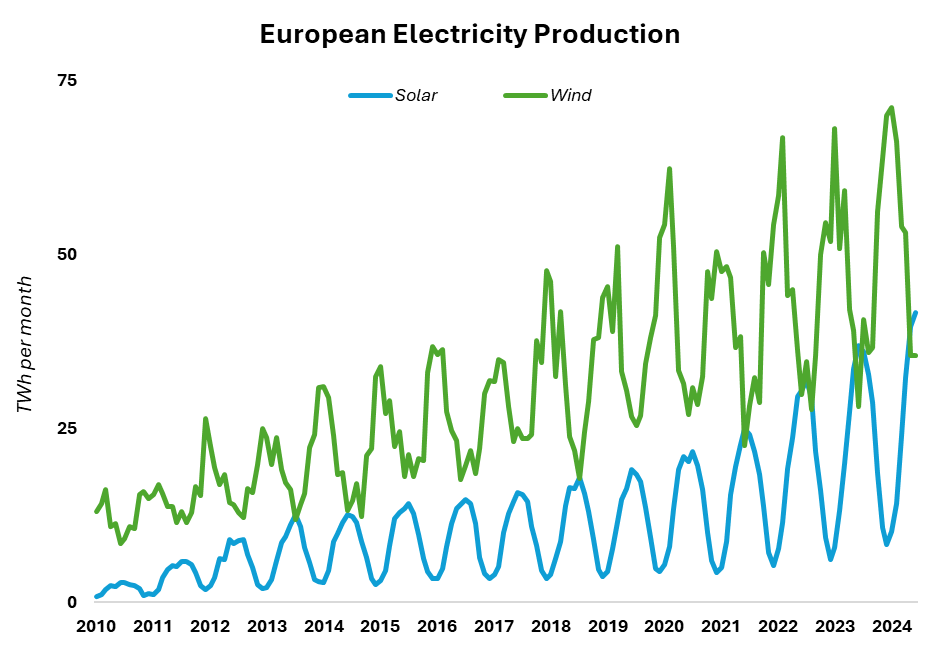

Europe is facing a monumental challenge as it transitions away from fossil fuels. While wind and solar are essential to lowering carbon emissions, they come with a significant issue: intermittency. Solar power, for instance, peaks during daylight hours but plummets at night. Wind can be seasonal and unpredictable. This variability makes energy storage and stable on-demand energy sources critical.

Source: IEA, Monthly Electricity Statistics (OECD - Europe)

Here’s where SMRs could come in. By providing constant, low-carbon baseload power, SMRs can help stabilize the grid and complement renewable energy as Europe phases out coal and reduces its reliance on natural gas. This is crucial as the European Union (EU) aims to reduce greenhouse gas emissions by 55% by 2030 and achieve net-zero emissions by 2050 under the European Green Deal. Balancing energy reliability while hitting these targets is no small feat, and SMRs could be part of the solution.

Current Developments and Challenges in Europe

While the development of SMRs has progressed rapidly in North America and Asia, Europe is just beginning to explore the technology. The UK is taking a lead role, with Rolls-Royce planning to deliver operational SMRs by the early 2030s.

Source: World Nuclear Association

Meanwhile, the European Industrial Alliance for Small Modular Reactors, launched by the European Commission in February 2024, is working to accelerate SMR deployment across the continent by streamlining regulations and fostering collaboration between industries and governments.

However, several challenges remain:

Regulatory Framework: Nuclear energy is highly regulated, and Europe’s regulatory framework will need a major overhaul to accommodate SMRs.

Public Perception: Despite their improved safety, nuclear energy still faces public skepticism, especially in countries like Germany and Austria, where nuclear phase-out policies are strong.

Investment: Although SMRs are more cost-effective than traditional nuclear plants, their upfront costs are still higher than wind and solar. Securing sufficient investment will be key to scaling SMRs across Europe.

Balancing Optimism with Caution

It's important to acknowledge that nuclear projects, even advanced ones, have faced setbacks in Europe. For example, Finland’s Olkiluoto 3 reactor, a traditional nuclear plant, was plagued by years of delays and cost overruns. Originally scheduled for completion in 2009, it only came online in 2023. While SMRs promise faster deployment and lower costs, these challenges highlight the importance of managing expectations. Even with SMRs, regulatory hurdles and public concerns could slow progress, especially in regions with strong anti-nuclear sentiments.

Source: "Technology-specific Cost and Performance Parameters", IPCC, 2018

How Do SMRs Compare to Other Energy Sources?

One of the biggest questions is whether SMRs can compete with other energy sources on cost. When comparing the Levelized Cost of Electricity (LCOE)—the average cost of producing electricity over a plant’s lifetime—SMRs are competitive with traditional nuclear but are still more expensive upfront than renewables like wind and solar. However, SMRs offer unique advantages, particularly in their reliability. Designed with high-capacity factors (often at 90%), SMRs can produce constant energy output regardless of external conditions, unlike wind and solar, which require expensive storage solutions to balance supply and demand.

As the EU's Emissions Trading System (ETS) progressively raises the price of carbon, the operational costs of fossil fuel-based energy sources will rise, potentially making SMRs more competitive over time. SMRs also boast low fuel costs and minimal emissions, making them an attractive option in a carbon-constrained future.

Canada’s SMR Action Plan: A Global Case Study

While Europe explores SMR technology, Canada has already laid out a comprehensive roadmap with its SMR Action Plan. The country is looking to deploy SMRs in remote communities and industrial regions where renewable energy options are limited. This strategy offers a blueprint for Europe, where certain regions might similarly benefit from the reliable, low-carbon energy SMRs provide. Canada’s approach highlights the practical applications of SMRs, particularly in places where other clean energy solutions are difficult to implement due to geography or infrastructure limitations.

Implications for the Commercial Real Estate Sector

The energy demands of CRE are increasing as buildings become more technologically advanced and energy intensive. Currently, the built sector accounts for about 37% of global CO2 emissions, and the pressure to decarbonize is mounting from both regulatory bodies and investors.

For property owners and managers aiming to achieve net-zero carbon goals, securing a reliable, low-carbon energy source is essential. While renewables will undoubtedly play a key role, SMRs could offer the consistent power needed to support advanced building technologies without the carbon footprint of fossil fuels.

Imagine a smart building running 24/7 data centers, powered reliably by an SMR integrated into the city’s energy grid. Property managers would no longer need to worry about the fluctuations of renewable energy supply or the volatility of fossil fuel prices.

As big tech players continue to be very vocal in advocating for nuclear energy to meet the increasing power needs of modern infrastructures, SMRs could help CRE stakeholders meet stringent energy efficiency and carbon reduction goals.

A Nuclear Option for Europe’s Green Future?

Small Modular Reactors represent an exciting innovation in the nuclear power industry. While challenges around cost, regulation, and public acceptance remain, the combination of reliability, scalability, and low-carbon output makes them a promising component of Europe’s future energy mix.

To meet its aggressive climate targets, Europe will need to consider all available options for clean, reliable energy. SMRs could be the missing link that complements wind, solar, and other renewables, offering a solution to the challenges of energy reliability and grid stability. And as decarbonization accelerates, industries like commercial real estate that rely on consistent power could benefit greatly from the unique advantages SMRs offer.

As Europe navigates this critical juncture in its energy transition, it’s worth asking: Could Small Modular Reactors be the key to unlocking a more sustainable, reliable energy future?

UPDATE 14/10/2024: Google just announced a groundbreaking deal with Kairos Power to purchase electricity from 6-7 SMRs to power its data centers, marking the first such agreement by a tech company. This initiative will provide up to 500 MW of carbon-free energy by 2035, supporting Google's decarbonization goals. The first reactor is expected to be online by 2030. The significance of this agreement lies in Google's role in supporting the development of new SMR technology from greenfield sites, rather than relying on existing nuclear facilities. By providing capital for the construction of next-generation reactors, this move could accelerate the deployment of advanced nuclear energy and signal a shift in how industries approach sustainable, 24/7 power solutions.